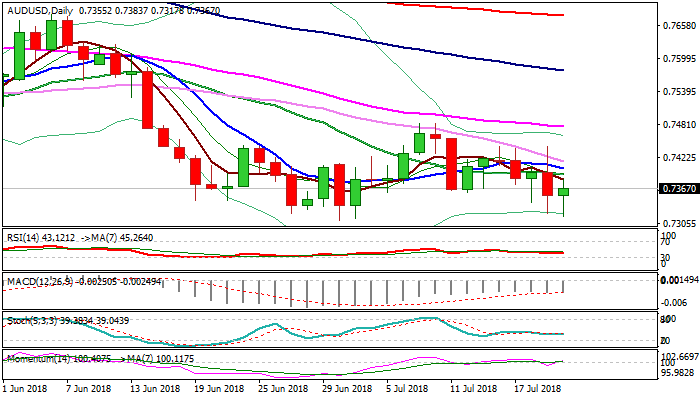

Bears to remain intact while 10SMA caps recovery

The Australian dollar bounced on Friday after hitting three-week low at 0.7317, ticks ahead of key support at 0.7310 (02 July low).

Weaker US dollar gave a breather to Aussie’s bears which track the weakness of Chinese yuan (posted new one-year low vs dollar).

Consolidation before breaking below 0.7310 pivot is seen as likely near-term scenario, with extended upticks to be capped by 10SMA (0.7404) to keep bearish structure intact.

Bears need confirmation on close below cracked pivot at 0.7325 (Fibo 61.8% of 2016/2018 0.6825/0.8135 uptrend) to generate bearish signal for fresh leg lower.

Break and close below 0.7310 would confirm and open targets at 0.7150 zone (lows of 24 June 2016 / 02 Jan 2017).

Conversely, close above 10SMA would sideline downside risk and signal stronger recovery.

Res: 0.7383; 0.7404; 0.7416; 0.7442

Sup: 0.7314; 0.7310; 0.7269; 0.7244