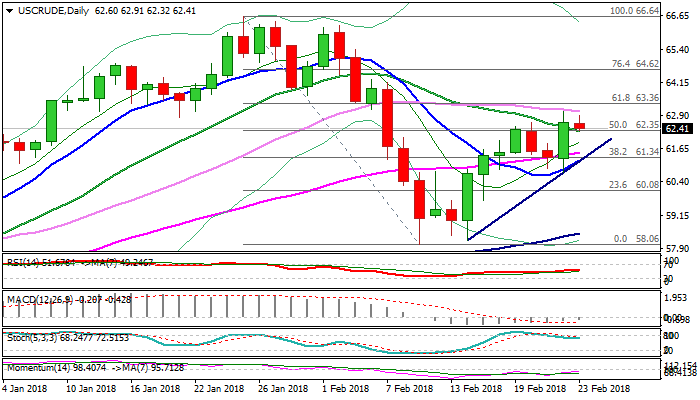

WTI OIL is consolidating after strong rally; rising daily cloud continues to underpin

WTI oil price is consolidating under fresh over two-week high at $63.07, posted on Thursday when oil prices surged on positive US crude inventories data.

EIA weekly report showed unexpected fall in US crude inventories against forecasted build which sparked strong rally.

Oil price accelerated above daily cloud and exceeded previous high at $62.63, on rally to $63.07 peak, generating strong bullish signal on close in long bullish daily candle.

Current consolidation is a result of profit-taking as well as traders digesting positive data which turned near-term bias bullish and sidelining fears of rising US output.

Structure of daily techs improved as oil price is gaining momentum, but daily MA’s are still in mixed mode.

WTI contract is on track for the second weekly bullish close which adds to positive near-term outlook.

Break above 30SMA which capped Thursday’s rally (currently at $63.05) and pivotal $63.36 barrier (Fibo 61.8% of $66.64/$58.06 downleg) is needed to generate stronger signal for bullish continuation.

Consolidation was so far contained by falling 20SMA ($62.30) with extended downticks expected to remain above the top of rising daily cloud ($61.90) to keep bullish bias intact.

Res: 63.05; 63.36; 64.27; 64.62

Sup: 62.30; 61.90; 61.52; 61.22