Aussie surges on upbeat jobs data but break through key barriers is needed to confirm reversal

The Australian dollar jumped 0.4% in Asia on upbeat jobs data which showed unemployment falling to the lowest in one year and employment figure doubled estimation.

Strong labor sector numbers improved the sentiment and reduced significantly expectations of RBA rate cut next month.

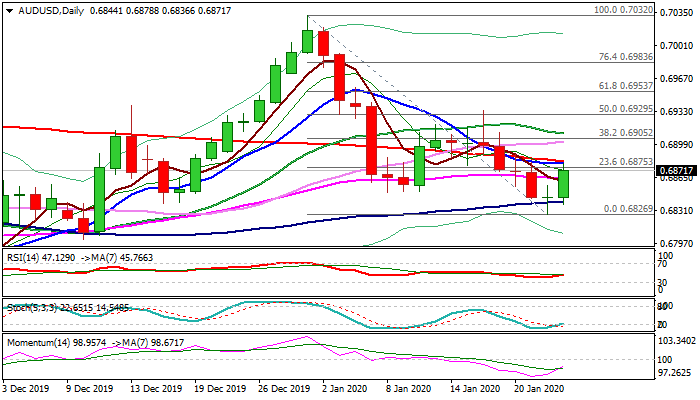

Fresh advance is about to complete Doji reversal pattern on daily chart as Wednesday’s action ended in long-legged Doji, signaling strong indecision and also forming bear-trap at 100DMA (0.6838).

Daily techs support recovery as price action returned above daily cloud, momentum is in steep ascend, stochastic emerging from oversold territory and RSI turned north.

Fresh bulls pressure pivotal barriers at 0.6880 (converged 10/200DMA’s / 50% of 0.6933/0.6826) break of which would add to positive signals and expose key obstacles at 0.6905/33 (Fibo 38.2% of larger 0.7032/0.6826 descend /16 Jan spike high).

Caution on failure to clear 0.6880/0.6905 barriers as overall picture is bearish and recovery stall may signal limited correction before larger bears continue.

Fears over spreading on virus in China, as millions of Chinese travel during Lunar New Year would also weigh on Aussie.

Res: 0.6880; 0.6905; 0.6933; 0.6953

Sup: 0.6858; 0.6839; 0.6826; 0.6819