Neutral mode extends; UK inflation data eyed for fresh signals

Cable is moving within narrow range around 1.30 handle in early Wednesday’s trading and awaiting UK inflation data for fresh signals.

Tuesday’s post-jobs data jump to 1.3048 was short-lived, as main forces that drive pound (positive impact from UK election and negative tone on concerns about UK/EU trade talks) conflict and lack clearer direction signal.

Mixed UK jobs data on Tuesday had minor impact sterling, as fresh optimism over falling cases of new virus cases that boosted risk appetite, also failed to move sterling significantly.

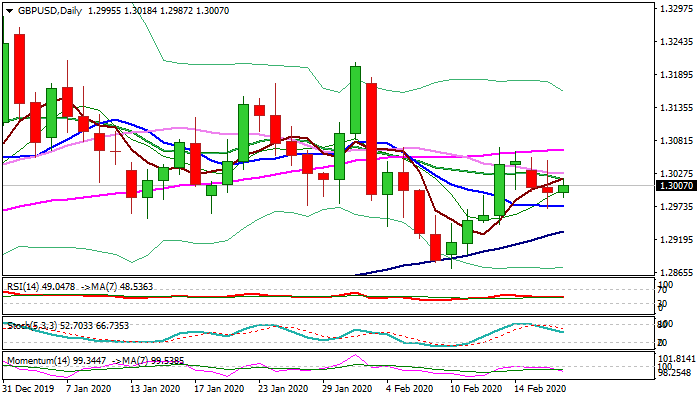

Daily MA’s remain in mixed setup and RSI is flat, while momentum and stochastic are bearishly aligned, keeping the pair in directionless near-term mode.

Annualized UK CPI is forecasted to rise in Jan (1.6% f/c vs 1.3% prev) and strong figure would inflate pound for probe above 20/30 DMA’s (1.3017/26 respectively) that would open way for retest of upper pivot at 1.3066 (55DMA).

On the other side, weaker than expected readings would increase pressure and risk another test of pivotal 10DMA support (1.2973) loss of which would weaken near-term structure.

Res: 1.3017; 1.3026; 1.3048; 1.3066

Sup: 1.2987; 1.2973; 1.2947; 1.2932