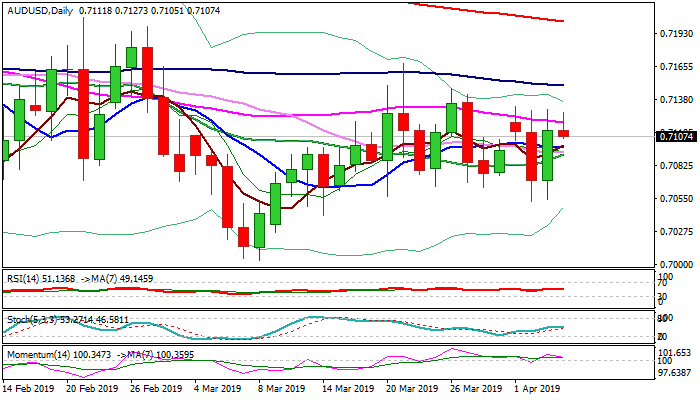

Recovery fails again to clear 55SMA

The Aussie dollar eases to 0.7100 zone following little benefit from renewed risk mode on signs of progress of US/China trade talks, as upside attempts were capped for the third consecutive day at 0.7130 zone and repeatedly failed to clearly break above 55SMA (0.7119).

Conflicting daily studies add to mixed signals.

Bullish bias expected to remain above a cluster of daily MA’s between 0.7092 and 0.7098 (converged 10;20;30 SMA’s), but repeated failures at 55SMA would keep the downside vulnerable.

Bullish scenario includes sustained break above 55SMA that would expose pivotal barriers at 0.7150/56 (100SMA / daily cloud top) and signal bullish continuation on break.

Near-term structure would weaken on close below 0.7092 (20SMA).

Res: 0.7119; 0.7149; 0.7156; 0.7203

Sup: 0.7100; 0.7092; 0.7066; 0.7054