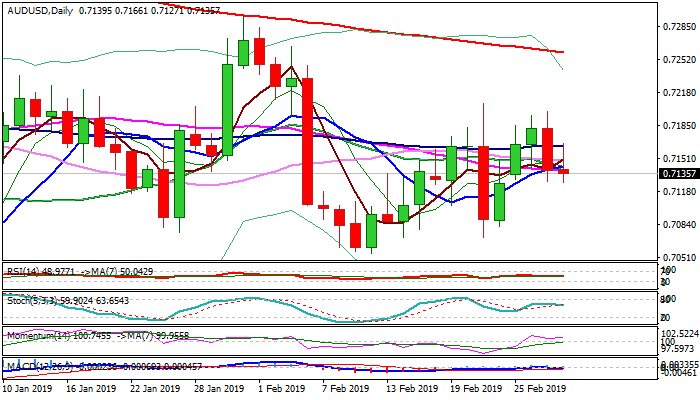

Slight bearish bias needs confirmation on break below temporary base at 0.7130

The Australian dollar consolidates after strong sell-off previous day, as renewed concerns over US/China trade talks soured sentiment.

Wednesday’s bearish outside day weighs, but fresh weakness found footstep at 50% retracement of 0.7054/0.7207 (0.7130).

Momentum remains strong on daily chart, but the pair lacks direction as signals are still mixed.

Firm break below 0.7150 would generate initial bearish signal for extension towards Fibo supports at 0.7112/0.7090 (Fibo 61.8% and 76.4% respectively) and would expose higher low at 0.7070 (21 Feb).

Bullish scenario requires initial signal from lift above broken Fibo barrier at 0.7149 (38.2% of 0.7054/0.7207) and extension above 100SMA (0.7163) to confirm bulls are back to play for renewed attack at pivotal 0.7203 barrier (Fibo 61.8% of 0.7295/0.7054).

Res: 0.7146; 0.7163; 0.7203; 0.7238

Sup: 0.7130; 0.7112; 0.7090; 0.7070