Slight bullish bias after downbeat Japanese GDP

The pair extends sideways mode into second day, with Monday’s action being slightly bullishly aligned but still holding within Friday’s range.

Downbeat Japanese GDP data (Q4 -1.6% q/q vs -0.9% f/c and 0.1% in Q3) had little impact but yen is a tad weaker after data release.

The latest attempts of Chinese authorities to cushion the impact of spreading coronavirus, restored investors’ confidence and boosted demand from riskier assets that weighs on safe-haven yen.

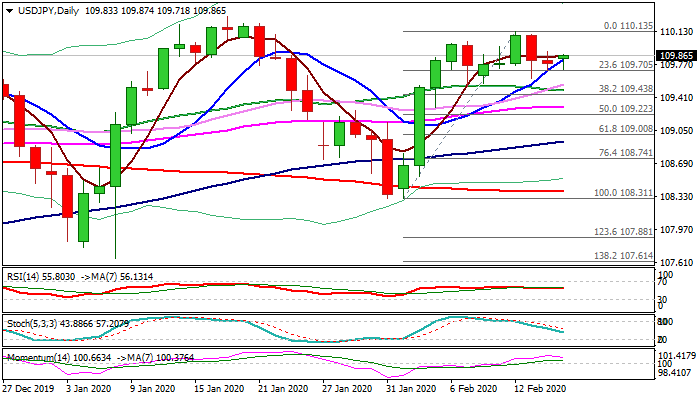

Pullback after repeated failure to clear 110 barrier was so far contained by weekly cloud top, with near-term bias expected to remain with bulls while this support holds.

Break lower would expose another significant support at 109.43 (Fibo 38.2% of 108.31/110.13), loss of which would spark stronger weakness.

Res: 109.91; 110.13; 110.29; 110.52

Sup: 109.70; 109.57; 109.43; 109.22