WTI oil price consolidates under new multi-week high, awaiting President Trump’s verdict on tariffs

WTI oil price is trading under new five-week high ($72.08, posted on Tuesday) after the price rallied 2.8% on Monday (the biggest daily gain since Jan 15).

Slight easing so far looks more like a consolidation rather than stronger profit-taking as markets turned to quiet mode and await the verdict about tariffs from US President Trump (due later today).

Positive factors that boost oil demand were threats from the US on imposing the secondary tariffs on buyers of Russian oil, better than expected China’s recent economic data which boost hopes for stronger demand from the world’s number one oil importer and growing tensions between the US and Iran.

OPEC+ will meet on Thursday and expect to stick to plans for further output increase from May that would partially counter the impact of supportive factors.

All eyes are now on President Trump’s tariff announcement, which is likely to be the key driver.

Market are expected to be volatile, and reaction will directly depend on size and scope of new tariffs.

Aggressive tariff rhetoric would further fuel fears of economic slowdown and inflation rise, which would have a negative impact short-term outlook and deflate oil price.

Conversely, softer than expected Trump’s stance on tariffs would keep larger bulls in play and provide fresh support to oil price.

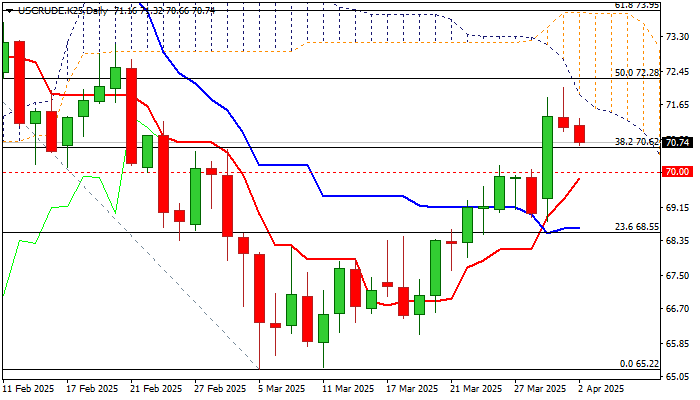

Technical studies are mixed on daily chart, as positive momentum remains strong and north-heading daily Tenkan-sen is diverging from daily Kijun-sen after forming a bull-cross, while the price action remains weighed by falling and thickening daily Ichimoku cloud (base lays at $71.58).

Good supports lay at $70.69/62 (100DMA / broken Fibo 38.2%) followed by $70 zone (psychological, reinforced by rising daily Tenkan-sen).

Daily cloud base marks initial barrier, followed by $72.08 (new high) and $72.28/50 (50% retracement of $79.35/$65.22 / 200DMA).

Res: 72.08; 72.28; 72.50; 73.12

Sup: 70.62; 70.42; 70.00; 69.70