Gold may rise above $3500 if geopolitical situation escalates further

Gold surged to the highest in seven weeks ($3444) overnight following Israel’s attack on Iran that fueled safe haven demand and quickly lifted the price.

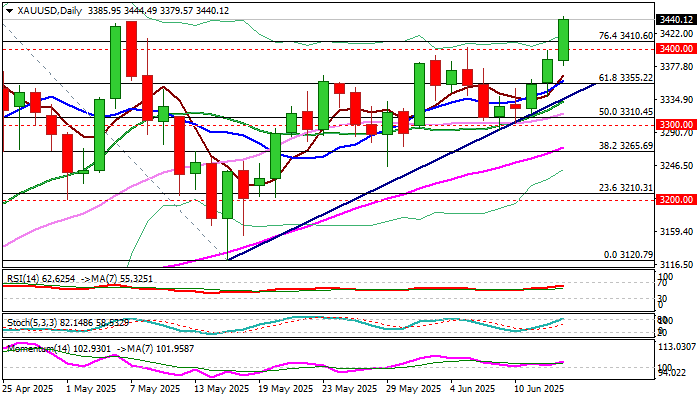

Break of $3400 zone (former strong resistances that reverted to supports) further brightened near-term outlook with weekly close above these levels to confirm bullish signal and keep focus on key target at $3500 (new record high).

Technical picture remains firmly bullish on daily chart, but bulls may slow here due to partial Friday’s profit-taking, as well as from stochastic entering overbought territory.

However, the latest action was mainly driven by geopolitical tensions, and the same factor is expected to continue to strongly influence price movements in the near future.

From the recent rhetoric on both sides, we can assume that tensions may either slightly decrease but will remain overheated and that would keep the price temporarily capped but strongly elevated or will further escalate (currently sounds like more likely scenario).

In such environment, gold would surge through $3500 pivot and focus targets at $3589 / $3600 / $3645 (Fibo projections / psychological.

Supports at $3410 (hourly higher base), $3400 (psychological) and $3380 (today’s low) should hold and keep fresh bulls fully in play.

Res: 3471; 3487; 3500; 3550

Sup: 3414; 3400; 3380; 3355