Gold remains at the back foot but still above key supports

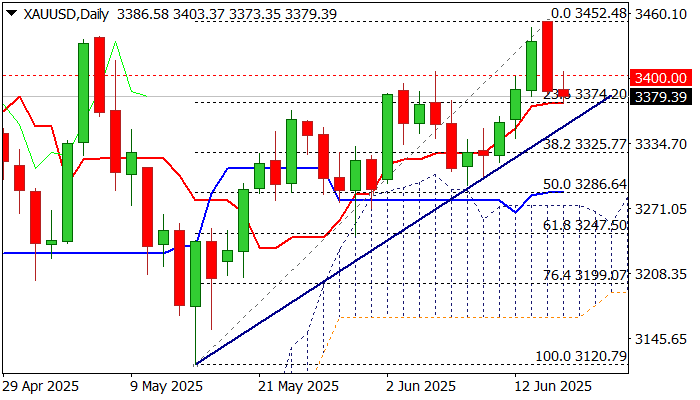

Gold trades within a narrow range on Tuesday morning, following almost 2% drop on Monday and daily close below psychological $3400 support (reverted to resistance and caps the action for now).

Surprise drop despite escalation of conflict between Israel and Iran still looks as correction and positioning for fresh push higher, as initial support at $3374 (Fibo 23.6% of $3120/$3452 / daily Tenkan-sen) contained dip.

Technical picture on daily chart is still bullish (strong positive momentum / Tenkan/Kijun-sen in bullish setup), but Monday’s bearish engulfing warns that downside pressure exists.

Depper pullback will face a trendline support at $3350 and should not exceed $3325 zone (Fibo38.2%) to mark a healthy correction and provide better levels to re-enter bullish market.

Alternatively, key supports at $3286 (daily cloud top reinforced by Kijun-sen / 50% retracement) would come under increased pressure.

Res: 3410; 3437; 3452; 3500

Sup: 3374; 3350; 3325; 3300