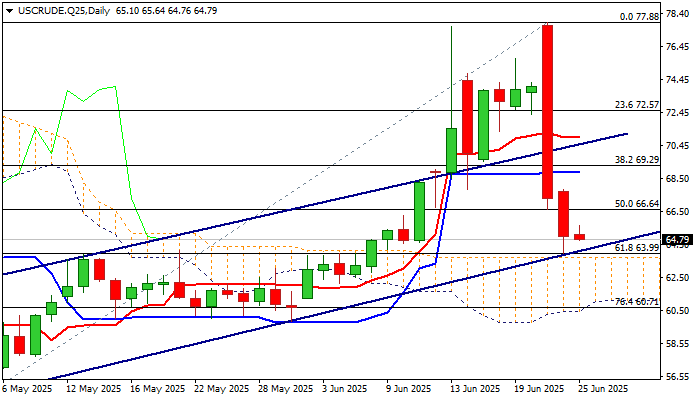

WTI oil – bears pause above daily cloud

WTI oil price ticked higher on Wednesday morning as bears take a breather after a massive losses in past two days (down around 16%).

Bears found solid support at $64.00 zone (Fibo 61.8% of $55.40/$77.88 rally / just above top of thick daily Ichimoku cloud) with oversold daily conditions adding to scenario of a partial profit-taking from recent sharp fall.

Recovery attempts were so far minimal and capped by broken 100DMA ($65.78) which now acts as initial resistance, still away from upper triggers at $67.25 (Fibo 23.6% of $77.88/$63.97), $68.55 (200DMA) and $69.28 (Fibo 38.2%), violation of which to generate stronger bullish signals.

Meanwhile, the downside is expected to remain at risk, as near-term picture heavily weighed by large bearish daily candles, daily bearish engulfing and weakened daily studies, as well as expectations from OPEC+ to further increase production.

Bears may hold in prolonged consolidation while supports at $64.00 zone hold, but loss of these supports would generate strong bearish signal and open way for continuation of fall from $77.88 (June 23 top).

Res: 65.78; 66.95; 67.25; 68.55

Sup: 64.20; 64.00; 63.69; 62.50