GOLD – fresh rally provides temporary relief and boosts optimism

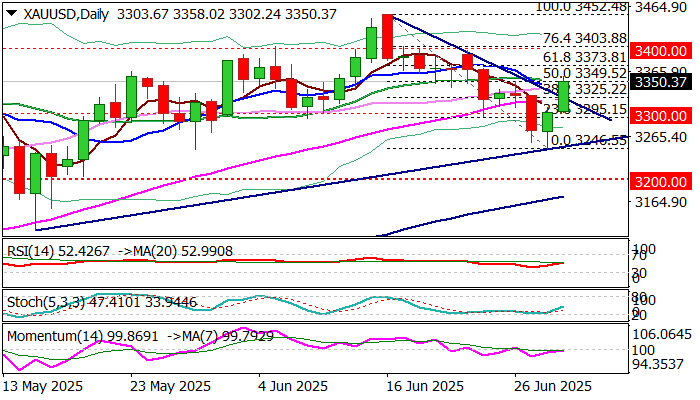

Recovery leg from $3246 (June 30 low) extends into second consecutive day and accelerated on Tuesday, recovering over 50% of the fall seen in past two weeks.

Weaker dollar on fresh tariff uncertainty as Trump’s July 9 deadline nears and his latest notification that there will be no further extension, lifted gold price.

Markets are also concerned about tax cut and spending bill, which President Trump want to be passed before July 4, add to gloomy outlook and contribute to fresh migration into safety.

Near term outlook has brightened after the recent downtrend was contained by top of daily Ichimoku cloud and subsequent bounce pushed the price away from dangerous zone below $3300, for now.

Daily close above broken Fibo level at $3325 (38.2% of $3452/$3246 bear-leg), also broken bear-trendline, is seen as minimum requirement to keep fresh bulls in play while close above cracked $3350 barrier (50% retracement / 20DMA)) would further strengthen near-term structure and shift focus towards $3373 (Fibo 61.8%).

Technical picture on daily chart is improving, although with warning signal from 14-d momentum which holds at the centreline, while overbought 4-h studies suggest that bulls may take a breather after strong acceleration today.

Consolidation or shallow correction should be contained above $3325 to keep near-term action biased higher.

Res: 3358; 3373; 3400; 3437

Sup: 3330; 3325; 3302; 3295