GOLD – bullish bias above $3325, US fiscal uncertainty underpins

Gold was firmer on Friday morning and recovered a part of post-NFP losses.

The metal is on track for a weekly gain after being in red for two consecutive weeks that adds to positive signals, as the price remains at the upper side of larger consolidation range ($3500/$3120).

Negative impact from upbeat US labor data was short-lived, with growing fiscal concerns after the US Congress passed President Trump’s tax-cut and spending bill (which will add $3.4 trillion to a massive US debt) expected add pressure on dollar and underpin safe-haven demand.

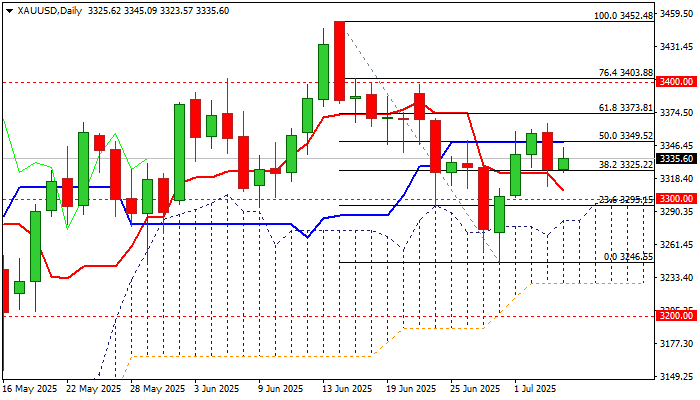

Technical picture on daily chart is still mixed as near-term action remains supported by thickening daily Ichimoku cloud, but positive signal being countered by 14-d momentum still in negative territory and overbought stochastic.

Near-term bias is expected to remain with bulls while the price holds above $3325 (broken Fibo 38.2% of $3452/$3246) though sustained break above cracked $3350 barrier (50% retracement / daily Kijun-sen) and $3365 (Thursday’s high) required to strengthen near-term structure and shift focus on targets at $3373 (Fibo 61.8%) and $3400 (psychological).

However, Friday’s action is likely to be less dynamic due to lower volumes, as US markets will be shut for Independence Day.

Res: 3345; 3350; 3365; 3373

Sup: 3325; 3311; 3308; 3300