Gold dips on stronger dollar but key supports still hold

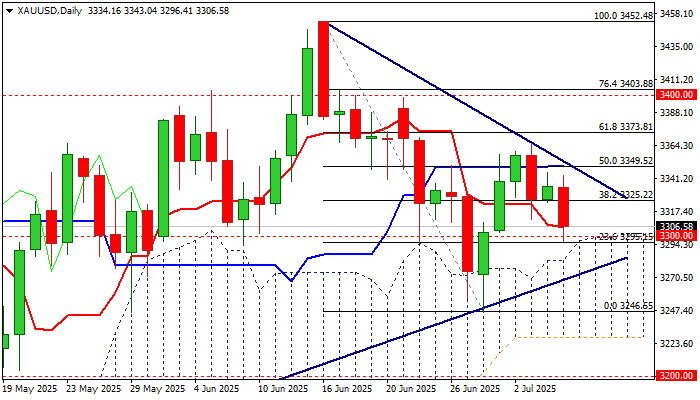

Gold price fell to one-week low on Monday after bulls repeatedly failed on approach to pivotal barrier at $3349 (50% retracement of $3452/$3246 bear-leg / daily Kijun-sen), with stronger dollar on risk aversion adding pressure on metal’s price.

Fresh weakness cracked psychological $3300 level, but bears were unable to clearly break lower, that keeps key support at $3282 (daily Ichimoku cloud top) intact for now.

Subsequent bounce (still limited) adds to potential scenario of rejection at $3300 and formation of bear-trap pattern that would open way for stronger recovery, although more work at the upside (lift and close above $3325 broken Fibo level) will be required to confirm scenario.

Caution on still predominantly bearish daily studies (negative momentum, 10/20/30 MA’s in bearish setup) that may keep the downside vulnerable while the price stays below $3325.

Look for initial bullish signal on break above $3325, with lift above $3350 to confirm, while break through $3360/65 (July 2/3 double-top) to bring bulls fully in play.

On the other hand, loss of $3300 handle would weaken near-term structure, but penetration into daily cloud would signal that bears regained control and risk retest of key $3250 support zone.

Res: 3325; 3345; 3353; 3365

Sup: 3300; 3286; 3282; 3270