Silver hits new multi-year high

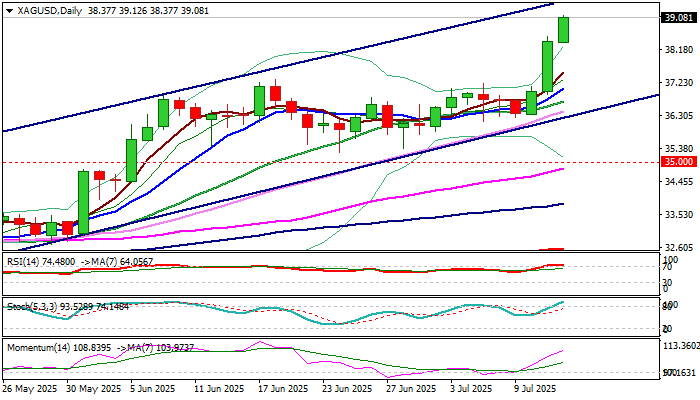

Silver hit the highest in nearly 14 years on Monday, testing levels above $39 as strong bullish acceleration extends into third consecutive day.

Growing uncertainty over US tariffs and weak economic outlook continue to fuel demand and underpin the price.

Fresh rally broke above recent $35.30/$37.30 consolidation range, signaling continuation of broader uptrend and unmasking psychological $40 barrier.

Technical picture on daily chart is firmly bullish but overbought that threatens of increased headwinds on approach to $40 target.

This may put bulls on hold for consolidation which should ideally hold above $37 zone (former breakpoint, reverted to support) to keep bulls intact for fresh push higher.

Sustained break above $40 to generate fresh bullish signal and expose targets at $40.68 (Fibo 76.4% of $49.78/$11.23, 2011/2020 downtrend) and $41.00 (round-figure).

Caution on loss of $37 handle that would weaken near term structure and risk attack at lower pivots at $35.00 zone (former range floor / broken Fibo 61.8% of $49.78/$11.23 downtrend).

Res: 39.50; 40.00; 40.68; 41.00

Sup: 38.25; 37.31; 36.15; 35.00