WTI oil edges higher on demand, crude stocks drop and uncertainty over peace talks

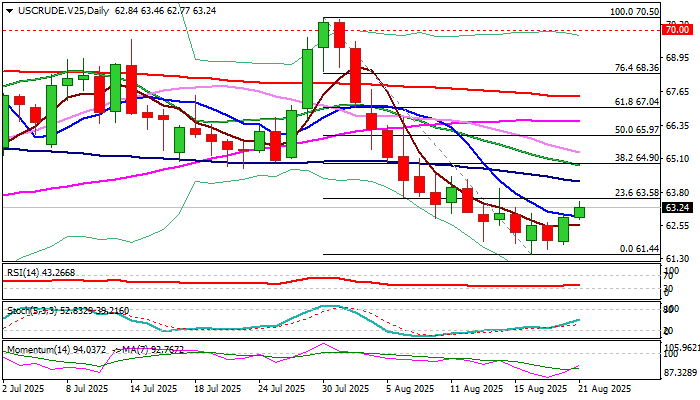

WTI oil price rose to one-week high on Thursday, adding to initial signals of basing and possible reversal, after the downleg from $70.50 (July 30 peak) found temporary footstep at $61.50 zone.

Expectations for growing US oil demand, uncertainty over Ukraine peace talks and much bigger than expected drop in US crude inventories, provided fresh support to oil prices.

However, recovery is still in initial phase and more work at the upside will be needed to generate clearer signal.

Fresh bulls broke above 10DMA ($62.91) and pressure initial Fibo barrier at $63.58 (23.6% of $40.50/$61.44), break of which will strengthen near-term structure for attack at upper pivots at $64.25/90 (100DMA / Fibo 38.2% retracement, reinforced by 20DMA).

Technical picture on daily chart is predominantly bearish and points to existing risk of recovery stall if bulls fail to clearly break $65.00 resistance zone.

Otherwise, list above $65.00 would expose targets at $66.00 and $67.00 zone (Fibo 50% and 61.8% respectively).

Traders will be closely watching the Ukraine peace talks, with extended tough negotiations without clear decision, to continue to underpin oil prices on prolonged uncertainty.

Conversely, signals moving towards workable solution will increase pressure on oil prices.

Res: 63.58; 64.00; 64.25; 64.90

Sup: 62.91; 62.58; 61.82; 61.44