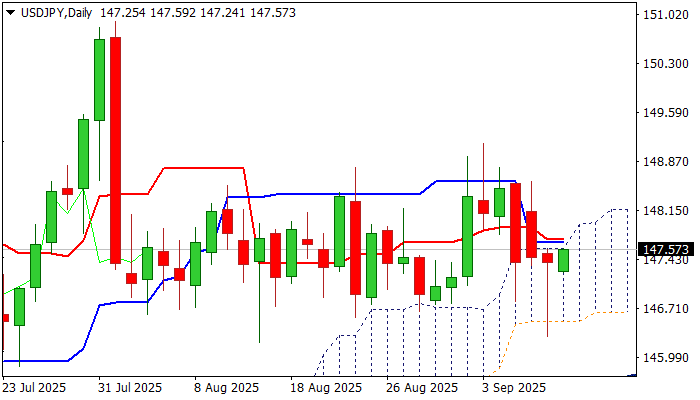

USDJPY – recovery attacks key barriers, bear-trap underpins the action

USDJPY regained traction on Wednesday, after spiking to the lowest in nearly one month on Tuesday.

Strong downside rejection formed a bear trap pattern (under daily cloud base), as well as Hammer candle (Tuesday), adding to developing positive signals.

Strong resistances at 147.60 zone (daily cloud top / converged 10/20 DMA’s) are under pressure, with sustained break here to strengthen near-term structure for fresh recovery towards targets at 148.05/46 (Fibo) and key barrier at 148.70 (200DMA).

Bullish near-term bias expected while the price holds above 55DMA (147.18), but caution is required as daily studies are bearishly aligned (daily RSI below 50 / 14-d momentum in negative territory).

Thursday’s release of US August inflation report will be in focus for the final signals ahead of FOMC policy meeting next week.

Res: 147.72; 148.05 148.46; 148.70

Sup: 147.39; 147.18;146.70; 146.30