WTI oil drops 2% on signals of further OPEC+ production increase

WTI oil price remains in red for the third consecutive day and accelerated lower on Tuesday, losing about 2% of its value during Asian / early European trading.

Oil price was initially deflated by optimism about potential US-China trade deal that stalled earlier strong rally sparked by US sanctions on two biggest Russian oil producers.

The latest signals that OPEC+ will further increase production in December (the cartel members will hold online meeting on Sunday), added to more pressure on oil prices.

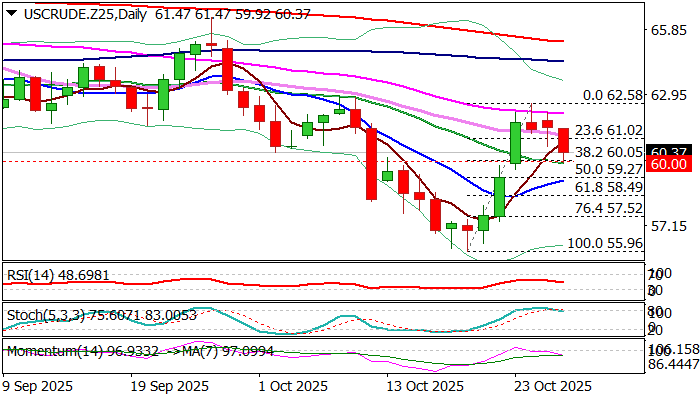

Fresh bears cracked important support at $60 (psychological / Fibo 38.2% of $55.96/$62.58 upleg / 20 DMA) but faced headwinds at this zone that so far prevented break lower.

Significance of the support and oversold hourly studies contributed to slight bounce, which rather marks consolidation, as daily studies are predominantly bearish (negative momentum / stochastic emerging from oversold zone / MA’s in mixed setup) and likely points to bearish continuation scenario.

Firm break of $60 trigger to expose targets at $59.27/12 (50% retracement / 10 DMA).

Conversely, ability to hold above $60 to temporarily sideline bears, while bounce and close above $61.00 zone (broken Fibo 23.6% / 30DMA) would provide relief.

Res: 60.66; 61.02; 61.47; 62.15

Sup: 60.00; 59.65; 29.27; 59.12