Gold rises over 2% on Monday, generates initial signal of an end of corrective phase

Gold rose over 2% at the start of the week and ticked above $4100 level, improving the near-term picture and sidelining the downside risk.

Fresh rise in demand was sparked by recent weak US economic data that increased pressure on dollar and revived expectations for Fed rate cut in December, while markets remain highly concerned about the depth of negative impact on the economy from the historically longest government shutdown.

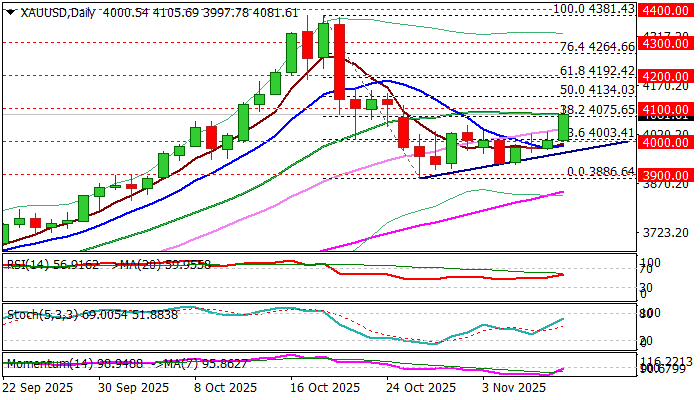

Today’s break above initial pivot at $4046 (former congestion top) and $4075 (Fibo 38.2% of $4381/$3886 correction /20 DMA), as well as brief probe above $4100 (psychological), generated strong bullish signal.

Daily studies improved following completion bullish failure swing pattern but still require more work at the upside (sustained break above $4100 and potential extension through Fibo 50% at $4134) to validate signal, as north-heading 14-d momentum needs to emerge from oversold territory.

Meanwhile, the price eased from new two-week high, as strongly overbought hourly studies sparked a partial profit-taking.

Dips should be limited and provide better levels to re-enter bullish market, with $4050 zone (50% retracement of today’s rally / former range top) to contain extended downticks and keep revived bulls in play for further advance.

Firm break through $4100 to open targets at $4134 (50% of $4381/$3886) and $4192/$4200 (Fibo 61.8% / psychological) in extension.

Res: 4100; 4134; 4150; 4192

Sup: 4050; 4038; 4020; 4000