BTCUSD extends steep fall well below psychological100K support

BTCUSD holds in a steep descend for the fourth consecutive, with strong acceleration lower on Thursday / early Friday, being sparked by fresh sales of risky assets.

Traders remain concerned about lack of economic data following the longest US government shutdown in history and moved into risk-off mode, until getting clearer picture.

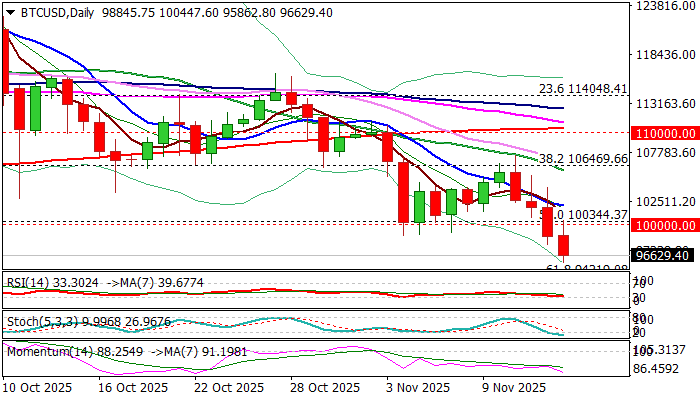

Bitcoin broke through key supports at 100340 and 100K (50% of 74389/126299 rally / psychological) and extended below June 22 low (98182), to test levels under 96K and hit the lowest since early May.

Bears eye next targets at 94219 (Fibo 61.8%) and 93203 (top of ascending weekly Ichimoku cloud, though price adjustment to be anticipated as daily studies are getting oversold.

The latest drop completed a bearish failure swing pattern on daily chart, adding to negative signals from firmly bearish daily technical studies (14-d descends deep into negative territory/ MA’s in full bearish setup, with converging 55/200DMA’s on track to form death-cross.

Broken supports at 101370 and 100K (55WMA / psychological) reverted to resistances which should ideally cap upticks, with close below these levels to keep bears intact.

Res: 98870; 100000; 101370; 102080

Sup: 95800; 94219; 93203; 92800