Gold keeps firm tone after 1.6% advance on fresh dovish signals from Fed

Gold keeps firm tone and consolidates under new 1 ½- week high on Tuesday, following Monday’s 1.6% advance.

The latest dovish comment from Fed policymakers revived hopes of Fed rate cut in December that brightened the sentiment and lifted yellow metal’s price.

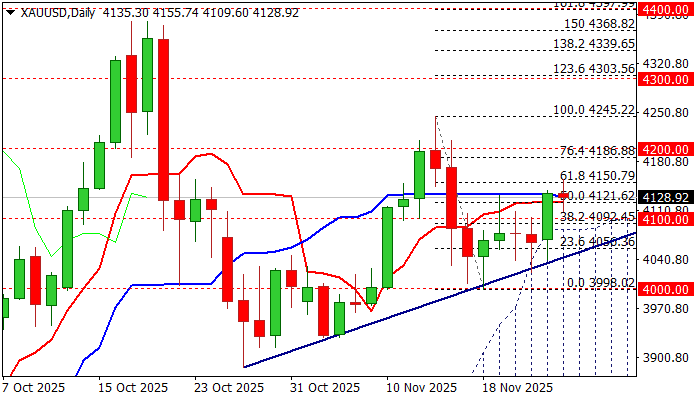

Technical picture on daily chart improved further, as near-term action remains underpinned by rising thick daily Ichimoku cloud, after cloud top contained recent attacks.

Positive momentum studies contribute to bullishly aligned outlook, though traders will also focus on delayed US economic data which are due to be released in coming days and expected to influence Fed’s view on monetary policy.

Repeated daily close above broken Fibo 50% of $4245/$3998 bear leg ($4121) to confirm positive signal and open way for lift through cracked Fibo 61.8% ($4150), Fibo 76.4% ($4186) and psychological barrier at $4200 in extension.

Caution on potential dip below $4100 zone (psychological / 10DMA) which can weaken near-term structure and risk retest of daily cloud top.

Res: 4155; 4186; 4200; 4211

Sup: 4120; 4100; 4056; 4043