Gold establishes above $4500 as fresh geopolitical tensions boost demand

Gold opened with gap higher and above cracked $4500 level on Friday, as geopolitical situation escalated during the one-day break on Christmas and prompted traders into fresh longs.

The latest US attack on Nigeria added to growing tensions over US pressure on Venezuela and war in Ukraine, which sees no results from the recent peace talks.

Growing expectations for more dovish stance of the US central bank in 2026, fragile economic situation, particularly in the western economies and strong physical buying of gold by the central banks, add to cocktail of strong factors that continue to lift metal’s price.

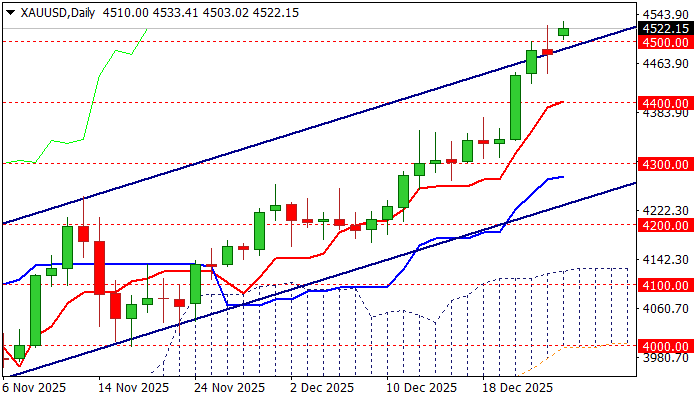

Gold hit new record high on Friday (so far marginally higher than Friday’s $4525 peak) and keeps firm bullish tone for further advance, as the price broke and holding above the upper boundary of short-term bull-channel (drawn off correction low at $3886).

Weekly close above $4500 to add to positive signals, as the yellow metal is on track for the third consecutive weekly gain, with this week’s advance being the biggest since the second week of October.

Immediate target lays at $4550 (round-figure), followed by $4570 (Fibo 138.2% projection) and $4600 (psychological), with the latest developments contributing to signals of stronger bullish acceleration.

However, overbought daily studies warn of pause for consolidation, with broken $4500 level now acting as solid support which should keep the downside protected.

Res: 4530; 4550; 4570; 4600

Sup: 4500; 4448; 4400; 4381