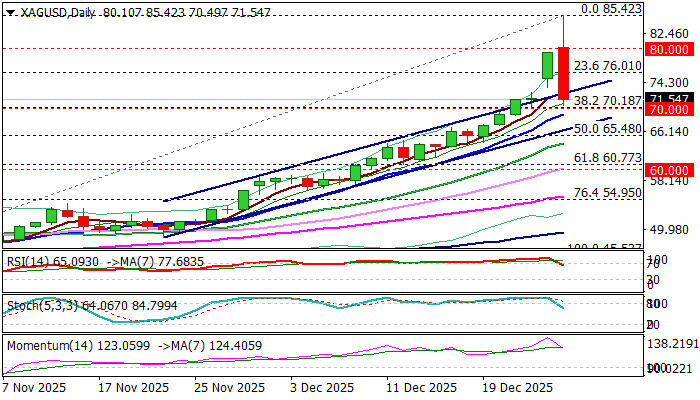

Silver price drops around $15 after hitting new record high above $85

Silver fell sharply in a turbulent Monday’s trading, after hitting a new record high above $85 at the start of Asian session.

Optimistic news about Ukraine peace talks and strongly overbought daily studies prompted traders to collect profits that resulted on a daily drop of nearly 10% so far.

Silver was up around 190% in 2025, moving in a very steep ascend during the most of the year and strongly gold, which gained around 70%, as both precious metals were supported by strong physical demand by the central banks, speculative trading on growing geopolitical and economic uncertainty, while the silver was boosted by strong industrial demand and supply shortage.

Today’s drop was the biggest daily loss in years and threatens to cover last Friday’s gap that would add pressure and open way for deeper correction, after the price moved in almost uninterrupted uptrend in past eight months.

Bears cracked supports $73.78 (rising daily Tenkan-sen) and $73.06 (broken upper trendline of bull-channel from $48.52 (Nov 21 low) and eye key targets at $70.18/00 zone (Fibo 38.2% of $45.53/$85.42 uptrend / psychological) which mark very strong supports, where bears may face increased headwinds.

On the other hand, loss of these supports may result in a deeper correction and unmask support at $65.48 (50% retracement).

South-heading daily indicators show enough space for extended correction, but this may not be sufficient to counter strong support from fundamentals, as demand remains firm and peace talks already showed cracks and unlikely to result in immediate agreement.

Res: 73.06; 73.57; 76.01; 80.00

Sup: 70.18; 70.00; 68.94; 66.91