Silver posts new all-time high on growing safe-haven and industrial demand

Silver hit new all-time high following over 6% advance on Monday, as fresh shockwaves from a criminal probe by Trump administration on Fed Chair Jerome Powell struck markets at the start of the week and prompted investors into safety.

Unrests in Iran, with threats of uncontrollable escalation, add to growing uncertainty and boost safe-haven demand, with silver being additionally supported by supply shortages, due to strong industrial demand.

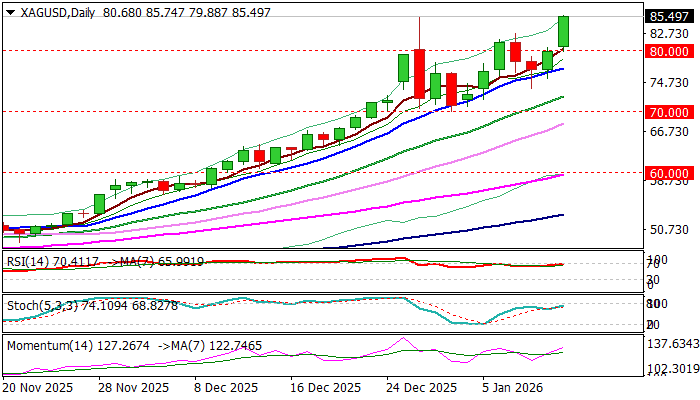

Completion of corrective phase from previous record high and bullish failure swing pattern on daily chart, generate fresh signal of continuation of larger uptrend that was paused for $85.42/$70.03 correction.

Close above former top is needed to confirm fresh positive signal, with violation of initial target at $86.06 (Fibo 100% expansion of acceleration from $70.03) needed to validate wave principles and open way for extension of the third wave of five-wave sequence (from $70.03) towards $90.00 (round-figure and 90.74 (FE 138.2%).

Dips on price adjustments should be shallow and hold above $80 to keep broader bulls in play.

Res: 86.06; 88.00; 89.05; 90.00

Sup: 84.60; 83.54; 82.73; 80.00