Oil prices rise further on Iran uncertainty and growing supply fears

WTI oil price extends steep rally into fourth consecutive day, as growing tensions over Iran fuel fears of potential supply disruptions. Adding to strong uncertainty was the latest threat from President Trump that he will impose a 25% tax to all countries that buy oil from Iran.

Slight optimism from Venezuela, where the situation is calmer and outlook for normalization of oil supply, did not make significant counter effect that kept oil prices rising.

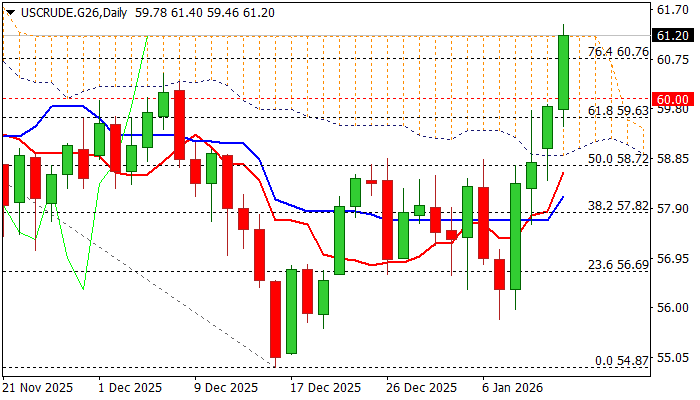

Today’s rally (oil was up around 2.7% for the day) broke important barriers at $60 (psychological), 60.25 (100DMA) $60.76 (Fibo 76.4% of $62.58/$54.87 descend) and $61.00 (round figure) and probed above the top of descending daily Ichimoku cloud ($61.18).

Improving daily studies support the action, though stretched indicators suggest that bulls may take a breather.

Limited dips are likely to mark positioning for fresh push higher, as geopolitical situation is fragile with serious risk of further escalation, which would spark stronger rally of oil prices.

Potential dips should find firm ground above broken $60 level to keep bulls alive, with sustained break above daily cloud to unmask targets at $62.24 (200DMA) and $62.58/80 (tops of Oct 24 / Oct 9).

Res: 61.18; 61.40; 62.24; 62.58

Sup: 60.76; 60.25; 60.00; 59.46