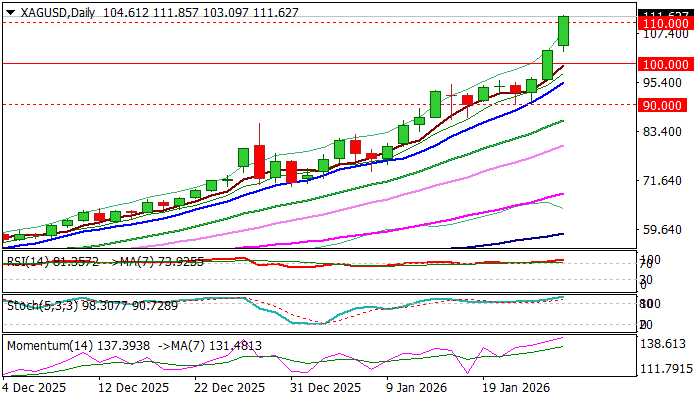

Silver accelerates higher after Friday’s break of psychological $100 level

Silver extends gains above psychological $100 level that was broken on Friday (market closed at $103.23) and hit new all-time high well above $111 on Monday.

Silver was strongly boosted by sharply rising demand for precious metals, strong industrial demand, which faces growing disbalance between demand and supply and weakening dollar, in which the price of metal is expressed.

Silver continues to track gold but has strongly outperformed the yellow metal with its 145% advance in 2025, compared to gold’s 66% gain.

The gold – silver ratio which indicates how many ounces of silver is needed to buy one ounce of gold, currently stands at around 46 (the lowest since Sep 2011) and signals that possession of silver should be converted to gold, although many say that the ratio is not relevant in today’s markets.

Silver made an impressive rally in January by advancing 53% until today (record rise), which adds to firmly bullish structure, but also warns of potential correction, due to overstretched studies on all larger timeframes, but also to the fact that the metal stays in steep and uninterrupted rally for nine consecutive months, which continued to accelerate and showed better performance each month compared to the previous month.

Strong bullish structure eyes sustained break above $110 to remain in play for acceleration towards targets at $115 (round-figure) and $116 (Fibo 138.2% expansion) guarding psychological $120 barrier.

Immediate support lays at $110, followed by 108.40 (hourly higher base), 105.40 (daily Kijun-sen) and 103.09 (daily low) and $100 (broken psychological resistance reverted to strong support, which should contain potential deeper dips and keep larger bulls in play for further gains.

Res: 112.00; 115.00; 116.00; 120.00

Sup: 110.00; 108.40; 105.40; 103.09