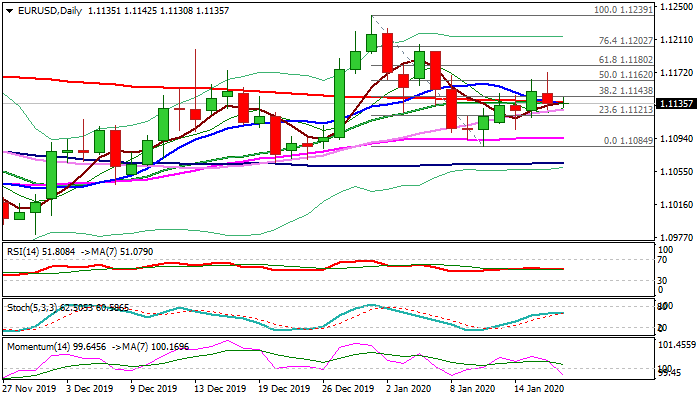

Initial signals of reversal generated after strong upside rejection

The Euro stands at the back foot in early Friday’s trading and returns below 200DMA (1.1135), adding to negative signal, generated on Thursday’s strong upside rejection which resulted in bearish daily candle with long upper shadow that hints formation of bull-trap pattern on daily chart.

Recovery rally from 1.1084 (10 Jan low) lost traction and increasing risk of reversal.

South-heading daily momentum broke into negative territory, RSI and stochastic turned sideways and death cross (10/200DMA) formed, adding to negative signals.

Today’s close below 200DMA would further weaken near-term structure and risk stronger easing.

Conversely, rally and close above pivotal barriers at 1.1137/43 (200DMA / Fibo 38.2% of 1.1239/1.1084) would sideline downside risk and improve near-term sentiment for renewed attempts higher.

EU inflation data (Dec CPI m/m 0.3% f/c vs -0.3% prev / Dec y/y 1.3% f/c vs 1.3% prev) are eyed for fresh signals, with a batch of US data, due later today, also being in focus..

Res: 1.1137; 1.1143; 1.1172; 1.1180

Sup: 1.1130; 1.1118; 1.1104; 1.1094