Bears take a breather after steep fall in past three days

The pair edged higher in early Wednesday’s trading, in consolidation after steep fall in past three days as dollar was sold on rising expectations of Fed rate cut.

Growing fears of coronavirus pandemic after signs of rising numbers of new virus cases are expected boost risk aversion and keep the pair under pressure.

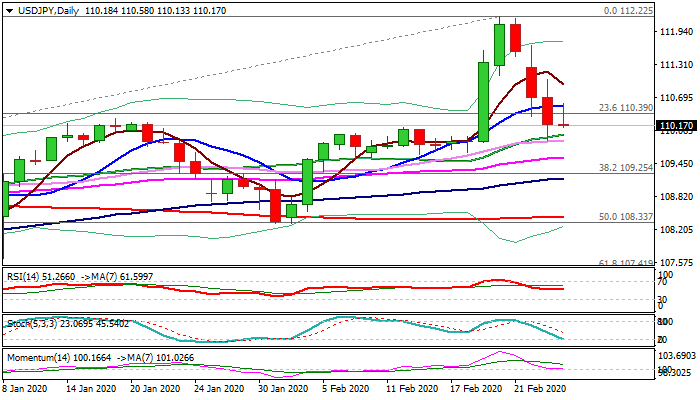

Tuesday’s action generated negative signal on close below 110.39/26 (Fibo 23.6% of 104.44/112.22 / daily Kijun-sen and cracked psychological 110 level (reinforced by rising 20DMA).

Firm break here is needed to confirm bearish signal and expose next pivots at 109.25/17 (Fibo 38.2% / rising 100DMA), violation of which would confirm reversal.

Limited upticks are expected to precede fresh weakness, with broken 10DMA (110.54) to ideally cap.

Only return and close above 111 barrier would sideline bears.

Res: 110.54; 111.00; 111.32; 111.67

Sup: 110.00; 109.89; 109.49; 109.25