Oil price surges on OPEC output talks optimism and geopolitical tensions

WTI oil price surged on Tuesday, making daily gains of 4.6% so far and on track for the biggest one-day rally since Nov 9.

Reduced risk sentiment deflated oil price on the first trading day in 2021, but bulls quickly regained traction, despite persisting fears of stalling demand growth on resurgence of Covid-19 across North America and Europe and subsequent lockdowns.

All eyes are on today’s continuation of OPEC+ output talks after the cartel members failed to reach agreement on Monday.

OPEC group studies more scenarios, with Saudi Arabia arguing against pumping more oil as new lockdowns are likely to limit demand, while Russia calls for higher production on recovering demand.

Crude oil rose almost 30% in the fourth quarter of 2020, lifted by optimism about global economic recovery and expectations that OPEC would tighten oil market and bring inventories lower in 2021.

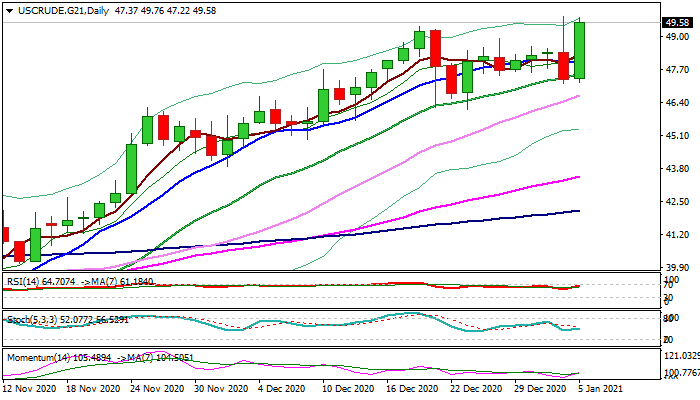

Fresh strength looks to break out of three-week consolidation for eventual attack at psychological $50 barrier, break of which would generate strong bullish signal and push oil prices to pre-pandemic levels.

Res: 49.80; 50.00; 50.99; 51.68

Sup: 48.94; 48.02; 47.16; 46.69