Oil prices extend weakness on prospects of lifting sanctions on Iran; supply concerns

WTI oil remains in red for the third straight day, weighed by renewed supply concerns over fresh rise in new virus cases in Asia, a progress in a talks towards a deal to lift sanctions on Iran, that would boost global supply and rise in US crude stocks.

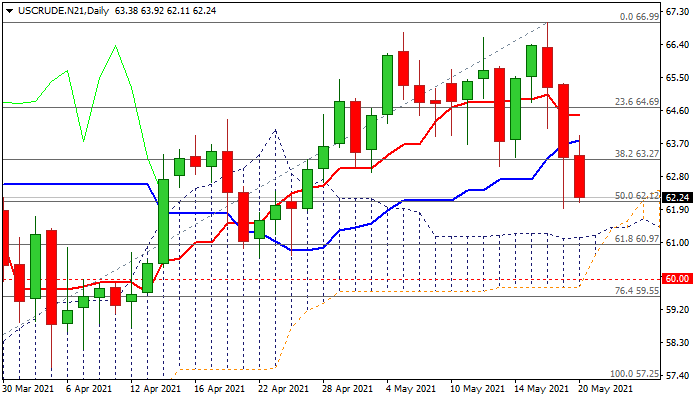

Fresh weakness pressures Wednesday’s low at $61.95 (the lowest in a more than three weeks), with sustained break here to open way towards key supports at $60.97 / $60.60 (Fibo 61.8% of $57.25/$66.99 / Apr 22 trough).

Weakened daily studies (10/20/30/55 DMA’s turned to bearish setup and momentum is holding in the negative territory) support fresh bears, with magnetic Monday’s daily cloud twist adding to negative signals.

Broken Fibo support at $62.12 (38.2% of $57.25/$66.99) reverted to strong resistance which should keep the upside protected and maintain fresh bearish bias.

Res: 62.75; 63.27; 63.97; 64.33

Sup: 61.95; 61.41; 60.97; 60.60