Expectations for tight supply supports oil prices but rise in new virus cases clouds the outlook

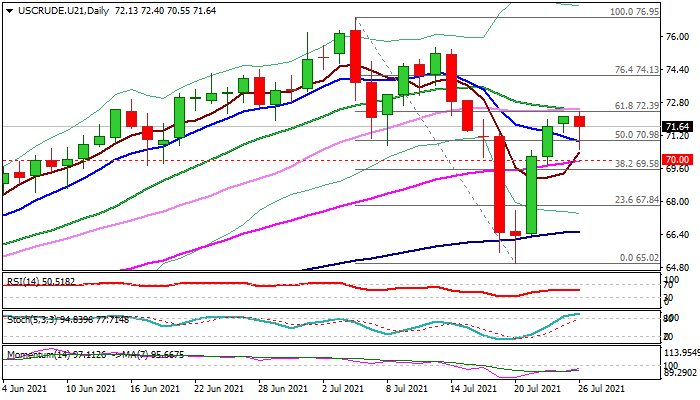

WTI oil remains steady on Monday, following strong rebound in past three days (up 8.5%), but the action faces headwinds from strong resistances at $72.39/50 (Fibo 61.8% of $76.95/$65.02 pullback / converged 20/30DMA’s).

Signals that crude supply is set to be tight for the rest of the year, support oil prices, but fresh spread of coronavirus Delta variant clouds the outlook.

Rise of virus cases prompted many countries to extend lockdown measures, with focus on China, world’s largest oil importer, which registered a rise in new virus cases that boost fears about possible drop in global demand.

On the other side, US demand remains strong that inflated oil prices in past few sessions along with expectations of tight supplies.

Technical studies on daily chart improved after strong bounce but still lacking firmer bullish signals.

Momentum is heading north but remains in the negative territory, while stochastic is overbought and both warn of recovery stall if bulls fail to clear pivotal barriers at $72.39/50.

Weekly hammer candle that was left last week was positive signal, but recovery needs sustained break above $72.39/50 to boost recovery.

Fundamentals are expected to be oil’s main driver and the price action may hold within $71.00/$72.39 range for extended consolidation, while awaiting fresh signals.

Return below $71 handle (10DMA) would weaken near-term structure, but loss of $70 support (psychological / 55DMA) would signal an end of recovery phase and shift near-term focus lower.

Res: 72.39; 72.50; 72.93; 74.13

Sup: 71.00; 70.55; 70.00; 69.58