Oil price rebounds after 12.5% drop on Friday; OPEC sees a reaction on Omicron news as overdone, not ready to change supply policy

WTI oil regained traction on Monday and bounced close to $73 per barrel, following a massive 12.5% drop on Friday, sparked by fresh fears that new Omicron variant would hurt global demand.

Oil prices rose after markets digested the news, seeing the reaction news about new virus variant as overdone.

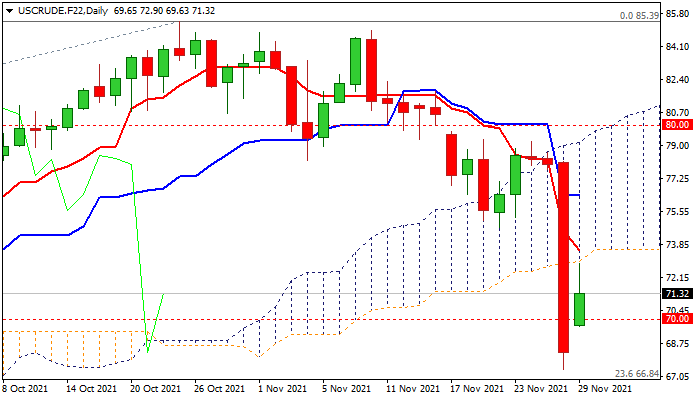

Oil price dropped to three-month low ($67.38) on Friday, retracing 76.4% of $61.81/$85.39 upleg) and generated a bearish signal on weekly close below $70 level (psychological / 200DMA).

Fundamentals are mixed as more news about new virus variant and its possible impact is required, while OPEC+ group, which meets later this week, said they are not worried about Omicron and see no need for urgent action on the market.

Recovery is still holding below the base of thickening daily cloud ($73.59) that keeps near-term bias with bears and risk of renewed probe below $70 in play.

Only bounce through $74.00/$75.00 zone (100DMA / former low of Nov 22) would ease bearish pressure and allow for stronger correction.

Res: 72.90; 73.59; 74.16; 74.75

Sup: 70.00; 69.63; 67.38; 66.84