Oil prices slump on renewed demand worries

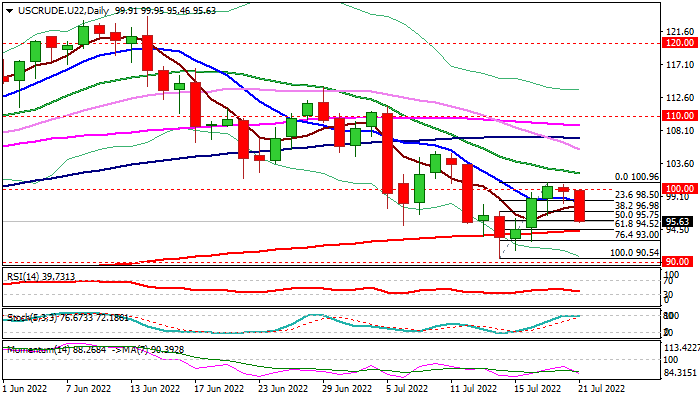

WTI oil price accelerates lower in European trading on Thursday (down 3.3% since Asian opening last night), after three-day recovery failed to sustain break above psychological $100 barrier.

Oil prices came under pressure from renewed demand worries on rising US gasoline stocks, gas flow through Nord Stream 1 pipeline resumed after a maintenance and Libya resumed production from several oilfields.

Traders are also concerned about the ECB joining other major central banks in raising interest rates to fight soaring inflation, as higher borrowing cost is likely to significantly hurt economic growth and consequently affect demand.

Fresh weakness already retraced 50% of $90.54/$100.96 recovery leg and signal that corrective phase is likely over.

Bears need extension through key supports at $94.52/$94.31 (Fibo 61.8% / 200DMA) confirm reversal and open way for another probe through key supports at $92.92/$92.64 (Mar/Apr higher base) after last week’s break lower failed to register close below these levels and generate fresh bearish signal.

Bearish daily studies add to weak fundamentals and support near-term action

Res: 96.50; 96.98; 97.83; 98.50

Sup: 95.00; 94.52; 94.31; 93.00