Oil price eases from new 2023 high ahead of Fed

WTI oil price extends pullback from new 2023 high ($93.71) into second consecutive day (down around 2% in Asian / European trading today) as traders partially collected profits and positioning for the Fed policy decision.

Overall picture remains bullish, with the price being underpinned by tighter supply (Saudi Arabia and Russia extended production cut until the end of the year) and brightening demand outlook, as China’s economic recovery gains traction.

Traders look for more details about the US economic growth outlook and its subsequent reflection on demand, which will contribute to oil’s near-term direction signals.

The Fed is widely expected to stay on hold this time, with focus to be on the central bank’s projections for the policy path in coming months, as well as signals whether the US economy is heading towards soft or hard landing.

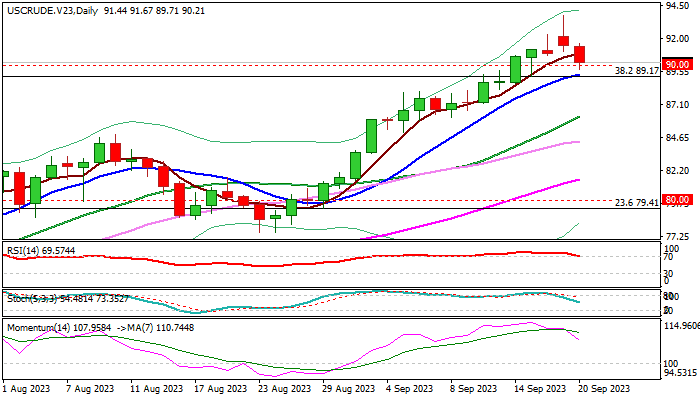

Technical indicators on daily chart also point to correction (fading bullish momentum / RSI emerging from overbought territory) though larger picture is bullish and suggesting limited correction before bulls resume.

Broken psychological $90 resistance (reinforced by daily Tenkan-sen) and $89.17 (broken Fibo 38.2% of $130.48/$63.63) reverted to solid supports which should ideally contain dips.

In such scenario, bulls could be revived quickly for fresh push towards pivotal barriers at $93.71 / $94.00 (Sep 19 high / top of thick weekly cloud), violation of which would spark stronger rally.

Initial warning on loss of $89.17 support, but increased downside risk to be expected on drop and close below $87.56 (Fibo 38.2% of $77.60/$93.71 bull-leg).

Res: 91.67; 92.32; 93.71; 94.00

Sup: 89.71; 89.17; 88.27; 87.56