WTI oil is consolidating under new 2023 high, on track for a quarterly gains of nearly 30%

WTI oil price is moving within a tight range but holding traction on Friday following a pullback from new 2023 high ($95.00) on Thursday (down 2% for the day).

Overall structure remains bullish, with tight supply on Saudi Arabia and Russia’s decision to extend their production cut for the rest of the year, offsetting concerns about lower demand on fragile conditions in western economies and slower than expected recovery of China’s economy (world’s second largest and top oil importer).

Oil price advanced almost 30% in the third quarter, with expectations to hit psychological $100 level if overall environment remains unchanged.

The contract is on track for bullish weekly close despite the latest easing and also for repeated close above $90 level, which will add to positive signals.

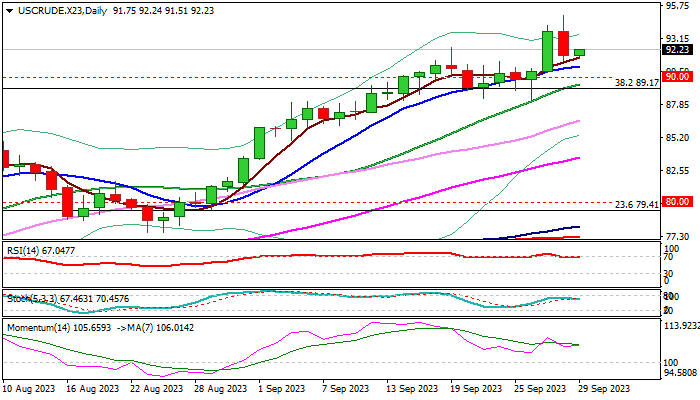

On the other hand, last week’s tight Doji candle and a long-legged candle forming this week, signal indecision, with overbought daily studies adding to signals that bulls may pause for consolidation.

Near-term action is also facing strong headwinds from the top of thick weekly Ichimoku cloud and may take some time to register a clear break higher.

Immediate support at $91.38 (Thursday’s low / rising 5DMA) holds for now and guard 10DMA ($90.84), with near-term bias expected to remain with bulls while the price stays above $90 level.

Caution on extension and close below $89.40/17 (20DMA / broken Fibo 38.2% of 130.48/$63.63) which would risk deeper pullback.

Res: 92.40; 93.42; 94.15; 95.00

Sup: 91.38; 90.84; 90.00; 89.40