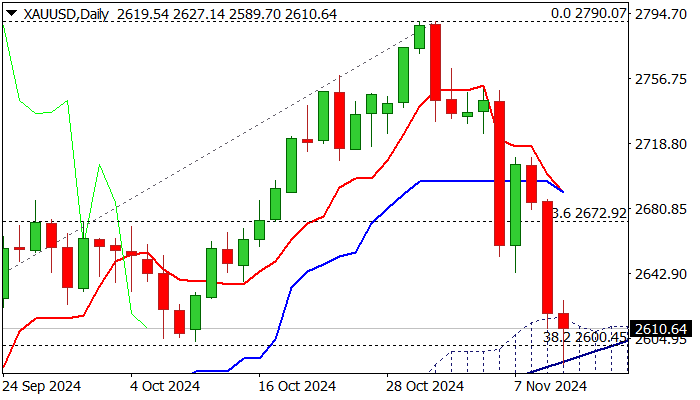

Gold falls to new multi-week low but bears face headwinds from significant $2600 support zone

Gold fell further and hit new multi-week low on Tuesday (the lowest since Sep 20) in extension of Monday’s 2.5% fall.

The yellow metal remains in steep near term downtrend since US election, deflated by victory of Donald Trump and expectations from his business and economy oriented policies which strongly lifted dollar.

Election results so far offset other key factors – geopolitics and concerns about global economic growth – which have recently strongly fueled safe haven demand and lifted gold prices to series of new record highs.

Fresh pullback from new all-time peak ($2790) cracked key support zone and is generating reversal signal.

Bears dented the top of rising daily Ichimoku cloud ($2616), Oct 9 higher low ($2605), Fibo 38.2% retracement of $2293/$2790 rally ($2600) and bull-trendline off $2293 low ($2590).

Clear break her to confirm bearish signal and open way for dip towards $2541 (50% retracement) and £2520 (daily cloud base).

Converged daily Tenkan/Kijun-sen are about to for a bear cross, and negative momentum is strong, adding to signals of weakening structure on daily chart.

However, $2616/$2590 support zone is significant and bears already face headwinds here, implying that near-term action may pause here, as markets await release of US inflation report for October as well as speeches from a number of Fed policymakers, which are expected to provide more details about Fed’s stance on interest rates in coming months.

Near-term bias is expected to remain with bears while the price holds below broken $2700 support, now reverted to pivotal resistance.

Only firm break here would sideline downside risk and signal a healthy correction before larger bulls regain full control.

Res: 2635; 2658; 2671; 2700

Sup: 2600; 2590; 2541; 2420