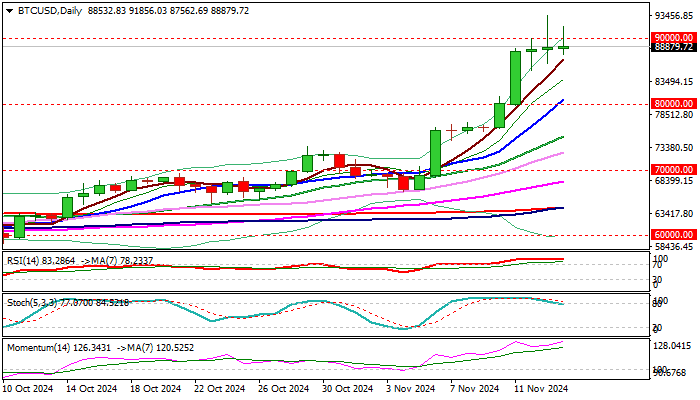

Bitcoin – congestion at 90K zone – initial signs of fatigue or consolidation for further gains?

Bitcoin remains well supported and holding near new record high at 93.5K, although facing difficulties to sustain gains above cracked psychological 90K barrier.

Long upper shadows on daily candles of today / Wednesday, send warning of potential fatigue, with repeated failure to register close above 90K to generate initial signal of formation of bull-trap on daily chart.

Overbought conditions, with stretched 14-momentum and stochastic emerging from overbought zone, contribute to such scenario, though more work at the downside will be required to validate signal.

On the other hand, various factors, with dominating role of ‘Trump trades’ continue to strongly underpin bitcoin price and keep in play scenario of extended consolidation before bulls resume.

Stand aside while the price holds within current congestion and await initial direction signal on violation of either boundary.

Rising 5DMA (86790) offers immediate support, followed by Tuesday’s spike low (85132) and upper 20-d Bollinger band (83839), guarding 10DMA (80810) and psychological 80K pivots.

New record peak (93539) acts as initial resistance, followed by 95029 (FE 261.8% of the third wave of five-wave cycle from 52563) and magic 100K barrier.

Res: 90000; 91856; 93539; 95029

Sup: 86790; 85132; 83839; 80810