Bitcoin keeps firm tone and holds in extended consolidation just under new record high

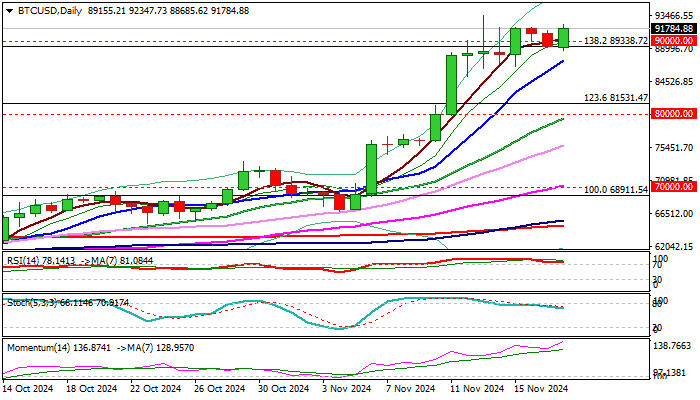

Bitcoin keeps firm tone and holds around 90K handle, in extended consolidation under new record high at 93.5K, posted last week.

Limited dips were contained above 85K, with more action seen in past four days, following three consecutive long-legged Doji candles.

The sentiment remains bullish and continues to ride on the waves of Trump trade, with current sideways mode suggesting that larger bulls are likely to resume after prolonged consolidation.

Adding to positive outlook was elevated US inflation which may prompt Fed to reduce the pace and the size of rate cuts, to add to Bitcoin’s appeal as a hedge against inflation, as well as safe-haven asset, on worsening geopolitical situation.

Bulls need weekly close above 90K (after last week’s action spiked to 93.5K but failed to register close above 90K) to signal that larger bulls are about to regain full control.

Break above 93.5K top to expose targets at 95K (round-figure) and 95648 (Fibo 150% projection), guarding psychological 100K barrier.

Initial support lays at 90K, followed by 88685 (today’s low) and rising 10DMA (87373).

Res: 93539; 95000; 95648; 96000

Sup: 90000; 88685; 87373; 85132