Bitcoin rallied to new multi-month high in the first trading day of 2024

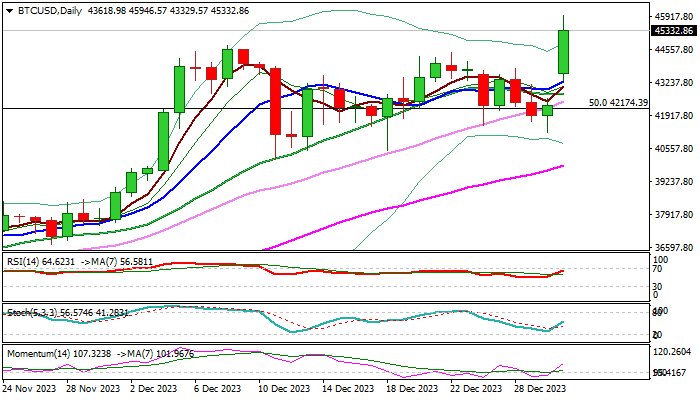

Bitcoin started 2024 trading with gap-higher opening and surged near $46000, the highest levels since April 2022.

Fresh rally was sparked by growing optimism that US securities regulator would soon approve exchange traded spot bitcoin funds, which greatly improved the sentiment.

Rise above the top of three-week range generated initial signal of an end of consolidation phase and continuation of a larger uptrend.

Daily close above former top (44743) is needed to keep fresh bulls in play for extension towards next targets at 48197/48484 (27 Mar 2022 lower top / Fibo 61.8% retracement of 68911/15437 downtrend) and confirm bullish continuation.

Firmly bullish daily studies support the action, with dips to be contained above 44500 zone and keep near-term bias with bulls.

Res: 45946; 46231; 46750; 47269

Sup: 44743; 44445; 43253; 42798