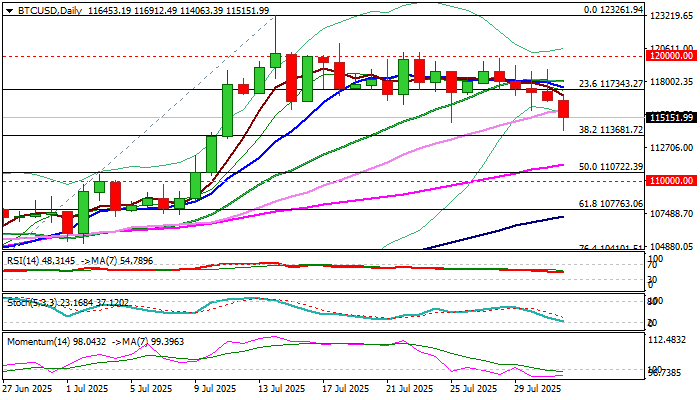

BTCUSD – break of two-week range floor is negative signal but key support still holds

BTCUSD fell to three-week low at 114K zone on Friday morning after the latest orders from President Trump to impose trade tariffs on a number of countries, soured the sentiment.

The latest dip that broke below two-week consolidation range generated fresh negative signal that weakened near term structure and shifted focus to the downside.

Daily studies show negative momentum and 10/20DMA’s in bearish setup that fuels negative outlook, as fresh bears pressure pivotal support at 113681 (Fibo 38.2% of 98182/123261 upleg).

Sustained break here is needed to confirm negative signals and open way for deeper pullback towards 112K zone (former record high), 110700 (50% retracement) and 110K (psychological).

However, ability to hold above 113681 Fibo level would ease downside pressure, but bounce above 10DMA (117500, around the mid-point of recent range) will be required to sideline bears and probably bring in focus key barrier at 120K.

Res: 116900; 117500; 118920; 120000

Sup: 114063; 113680; 112000; 111340