Crude oil price falls over 13% following attack on US bases in the Middle East

WTI oil price collapsed in late US session on Monday, following the latest news on Iranian attack at US military bases in the Middle East (Qatar and Iraq) in retaliation to US massive attack on Iranian nuclear installations, a day earlier.

Oil price fell from $74.30 where it was just before the attack, to $68.17, the lowest in one week, with total loss for the day of over 13% so far that presents the biggest daily drop in years.

The latest developments proved that markets may not follow a ‘textbook reaction’ even in case of escalation in oil rich Middle East region, as oil prices fell sharply when they should have logically skyrocketed.

The action coincides with President Trump’s warning to oil producers, released earlier today, to keep oil prices lower, ‘or they will deal with him.’

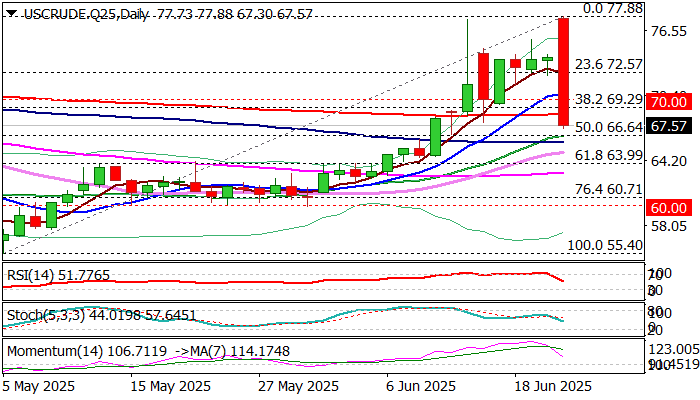

Technical picture weakened on daily chart, following today’s heavy losses that left a massive bearish daily candle, which also formed a massive bearish engulfing, and weighs heavily just due to its size.

Strong loss of bullish momentum (although the indicator is still in positive territory, break of important Fibo support at $69.29 (38.2% of $55.40/$77.88) and probe through 200DMA ($68.59) warn that the drop is not over yet.

Daily close below 200DMA to validate the latest bearish signal and open way for attack at $66.64 (50% retracement / 20DMA) and nearby 100DMA ($65.93), but this may not be the end, as falling RSI oscillator still has plenty of space at the downside.

Meanwhile, consolidation attempt above 200DMA was limited and short-lived, however, some corrective action in coming sessions, cannot be ruled out.

Res: 68.59; 69.29; 70.00; 70.34

Sup: 66.64; 65.93; 65.05; 63.99