Dollar index keeps firm tone ahead of Powell’s speech

The dollar index stood at the front foot and hit three-week high on Friday morning, as improved sentiment on Fed policy outlook continued to boost dollar in past few days.

Initial signals that the central bank may opt for more aggressive policy easing after disappointing July labor data, along with strong downward revisions of June and May numbers, were overshadowed by the latest inflation data which pointed to increased inflationary risk and tempered expectations for rate cuts, with significant drop in bets for widely expected September rate cut, contributing to more cautious approach.

All eyes are on today’s speech of Fed Chair Powell in Jackson Hole symposium, with expectations to get more information about Fed’s action in coming months.

Powell is very likely to put priority on inflationary risk against threats from weakening labor market, which would result in more hawkish stance, however, he may not come with many details as there will be release of another labor report before Fed’s September meeting, suggesting that Powell will be very cautious with his comments in Jackson Hole.

This may result in repeating his standard mantra that the central bank remains on track for policy easing, but any decision will be dependent on the latest economic data.

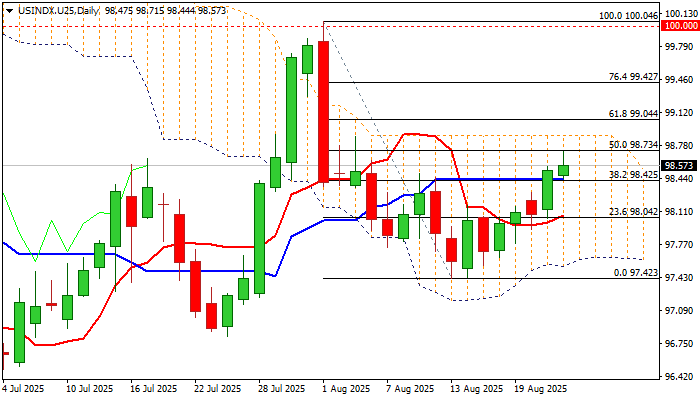

The dollar is so far on track for strong weekly gain which has retraced the biggest part of losses in past two weeks and about to complete weekly bullish engulfing pattern that would add to developing bullish signals.

Technical picture on daily chart has improved, but bulls started to face headwinds from cracked resistance at $98.73 (50% retracement of $100.04/$97.42 bear-leg, reinforced by falling 100DMA) and nearby daily cloud top ($98.88).

Bullish scenario requires break of $98.73/88 barriers that will signal continuation and expose targets at $99.42 (Fibo 76.4%) and $100 psychological / Aug 1 peak).

Broken Fibo 38.2% ($98.42) reinforced by daily Kijun-sen, marks solid support which should ideally hold and keep bulls intact.

Break here and dip through daily Tenkan-sen ($98.07) will be bearish.

Res: 98.73; 98.88; 99.04; 99.42

Sup: 98.42; 98.30; 98.07; 97.61