Dow rallies as positive earnings data improve the sentiment

The Dow Jones future contract jumped 0.75% after Wall St. opening on Friday, establishing in fresh upside direction after double Doji candles (Thu/Wed) signaled an end of three-day pullback.

Positive news, led by JP Morgan’s upbeat Q1 earnings and Chevron’s multi-billion-dollar acquisition boosted the sentiment in the US stock markets on Friday.

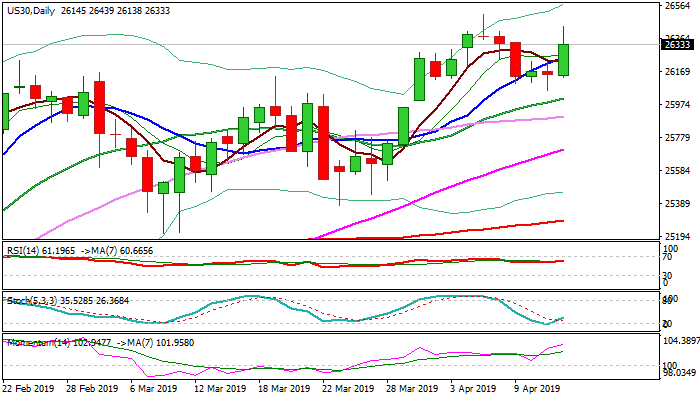

Dow’s short-term action remains strongly underpinned by rising thick daily cloud, as well as strong bullish momentum and daily techs in bullish setup.

Last week’s high at 26506 is in focus as today’s extension retraced over 76.4% of 26506/26059 pullback and break here would open way towards new record high at 26962 (posted on 3 Oct 2018).

However, risk of adjustment before final push through 26506 barrier exists as daily momentum crested and slow stochastic marks bearish divergence.

Improved environment after strong earnings data suggests that dips would be positioning for fresh advance and should find footstep above rising 20SMA (26010), to keep bulls intact.

Res: 26439; 26506; 26683; 26817

Sup: 26138; 26010; 25902; 25711