GOLD – bulls regained traction and establish above $3300

Gold keeps firm tone and attempts to establish above $3300 level, after the price hit the highest in over one week on Wednesday morning, in extension of Thursday’s 1.8% rally.

Fresh safe haven demand was fueled by further weakening of US dollar, which was also hurt by the US credit rating downgrade, while traders also opted to move into safety on fresh uncertainty over US Congressional debate on Trump’s tax cut bill, which could further undermine the US currency.

Adding to supportive factors for the yellow metal, was the latest media report about growing tensions between Israel and Iran.

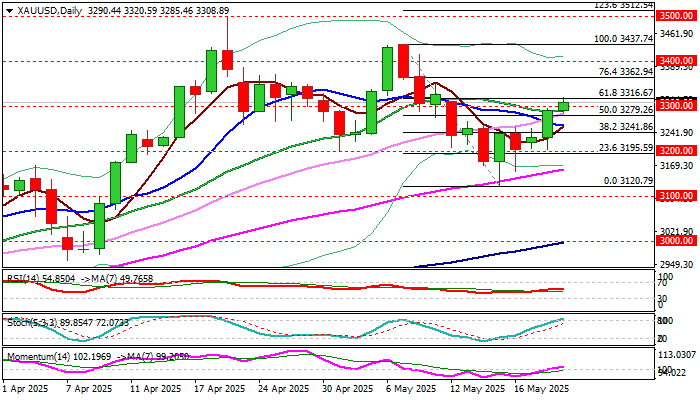

Technical picture has improved on daily chart after fresh acceleration higher retraced 61.8% of $3437/$3120 bear-leg and also left strong support at $3200 zone, where several attacks failed to register a sustained break lower and also left a bear-trap (under $3164 Fibo support).

Daily MA’s are back to full bullish setup, 14-d momentum broke into positive territory and heading north that underpins near term action, though bulls may take a breather, as conditions on daily and 4-hr charts are overbought.

Consolidation with limited dips is seen as likely scenario in current situation, with $3280 zone (broken Fibo 50% / near session low) to ideally contain and keep fresh bulls intact.

Reaction at $3300/16 zone will be closely watched, with sustained break through these levels to confirm bullish structure and expose targets at $3362/$3400 (Fibo 76.4% / psychological).

Caution on loss of $3280 handle that would risk attack at lower trigger at $3256 (10DMA).

Res: 3320; 3347; 3362; 3400

Sup: 3300; 3280; 3256; 3241