Gold – bulls take a breather under new record high ahead of key US inflation data

Gold price holds within a narrow consolidation under new record high on Thursday and reduced pace ahead of release of US inflation report.

Economists expect US consumer prices to rise further in August, mainly to be lifted by import tariffs, although optimism emerged from Wednesday’s lower than expected US producer Price Index in August that adds to expectations for Fed rate cut next week.

Fed is widely expected to deliver a 25-basis points cut next week, following a series of disappointing data which signal significant weakening in the labor sector, but the latest speculations suggest that possibility of 50-basis points cut is also in play.

Gold may come under pressure if CPI data beat forecast and receive fresh boost if August readings disappoint.

Overall picture remains supportive of the yellow metal, as high uncertainty on heated geopolitical situation and darkened economic outlook, are likely to continue to fuel safe-haven demand.

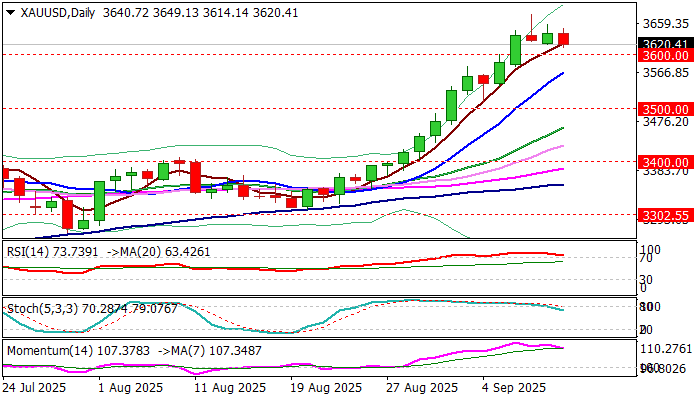

Overbought conditions on daily chart contribute to scenario of a partial profit-taking, though traders are likely to remain cautious and use limited dips to re-enter larger bullish market.

Res: 3657; 3674; 3690; 3700

Sup: 3600; 3577; 3567; 3536