Gold dips further, weighed by hawkish Fed / slightly calmer rhetoric in the Middle East

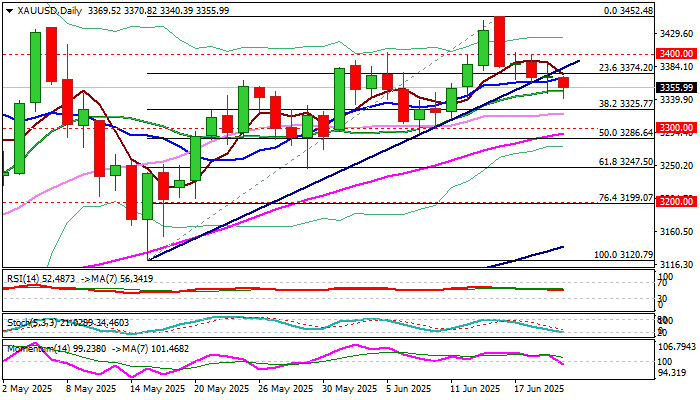

Gold dipped below important supports at $3374 (Fibo 23.6% of $3120/$3452 / bull-trendline off $3120 higher low) on Friday, deflated by less aggressive tones from the Middle East, as President Trump delayed announcement of decision whether the US will join the conflict, for two weeks.

The latest news boosted risk appetite, keeping safe-haven bullion in defensive, although traders refrain from stronger action for now, due to still high uncertainty.

Gold sentiment was initially dented by rather hawkish stance of the Fed, following the policy meeting on Wednesday, as the central bank kept interest rates unchanged and signaled that actions in the near future will highly depend on situation in the economy, labor sector and inflation.

On the other hand, President Trump reiterated his calls to Fed for more aggressive policy easing, suggesting that rates should be 2.5% lower to attract investments and boost economic growth, although he can not interfere the decisions of policymakers.

Technical structure on daily chart has weakened following loss of initial supports, while 14-d momentum entered negative territory that makes the downside more vulnerable.

Bears eye next targets at $3325 (Fibo 38.2%) and $3300 (psychological) but need to register close today below cracked 20DMA (3350) to validate signal.

The yellow metal is on track for bearish weekly close (gold was down around 2.8% for the week) that may add to downside prospects, if geopolitical situation does not escalate.

Broken trendline reverted to initial resistance, guarding upper trigger at $3400, break of which to sideline immediate downside risk.

Res: 3374; 3381; 3400; 3414

Sup: 3340; 3325; 3300; 3286