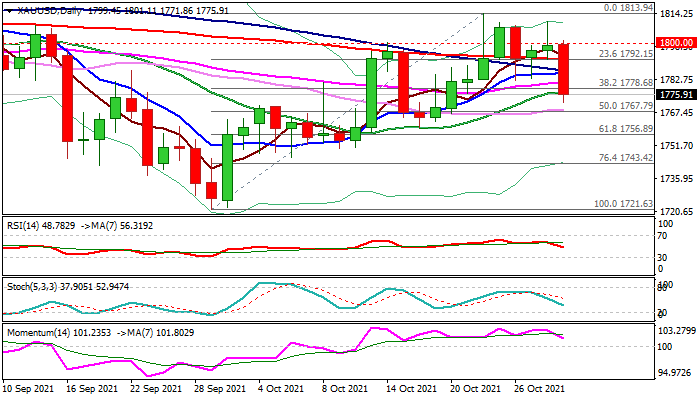

Gold drops after repeated failure at $1800 barrier

Spot gold dips to the lowest in over one week on Friday, pressured by higher dollar and rise in US bond yields.

The price accelerated lower and down 0.2% in the US session, on track for the biggest daily loss since Oct 15.

The yellow metal is also on course for bearish weekly close, with strong bearish signal seen on repeated failure to register a weekly close above psychological $1800 barrier (the price spiked to $1813 but unable to sustain gains above $1800).

This would weigh on near-term action and spark deeper correction, as fresh weakness already broke below $1778 pivot (Fibo 38.2% of $1721/$1813) with daily close below here to add to negative signals.

Daily studies weakened on the latest drop and continue to lose bullish momentum that supports negative scenario.

Weekly close below 20DMA ($1792) which kept the downside protected this week, is seen as minimum requirement to keep fresh bears in play.

Res: 1787; 1792; 1800; 1810

Sup: 1771; 1767; 1756; 1750