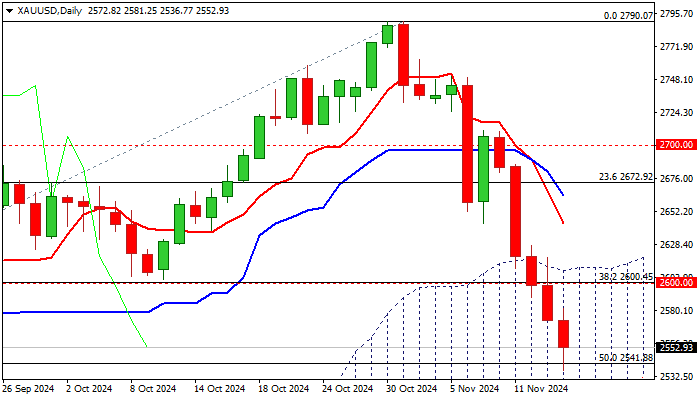

GOLD – extended pullback pressures daily cloud base

Gold remains under increased pressure and extends steep post-US election downtrend to the lowest in two months on Thursday.

Faded political uncertainty in the US and subsequent growing expectations that Trump’s policies will strongly boost the economy, were metal’s major drivers during the past one week.

Also, new measures are expected to boost inflation and subsequently to pressure Fed for less aggressive action on interest rates in the near future, however, markets so far dismiss gold’s appeal as a hedge against inflation that keeps the price in downward trajectory.

Pullback from new all-time high ($2790) has so far retraced 50% of $2293/$2790 bull-leg) and moved through rising thick daily Ichimoku cloud (currently trading near cloud base at $2524) but started to face headwinds.

Watch reaction on pivotal $2542/24 support zone (100DMA / daily cloud base) or $2600 zone (broken Fibo 38.2%) / cloud top, with break on either side to generate fresh direction signal.

Res: 2581; 2600; 2618; 2643

Sup: 2542; 2524; 2500; 2483