Gold extends pullback on growing risk sentiment

Gold price falls for the second day, as growing optimism over possible US-EU trade deal continues to fuel risk appetite and deflates safe-haven demand.

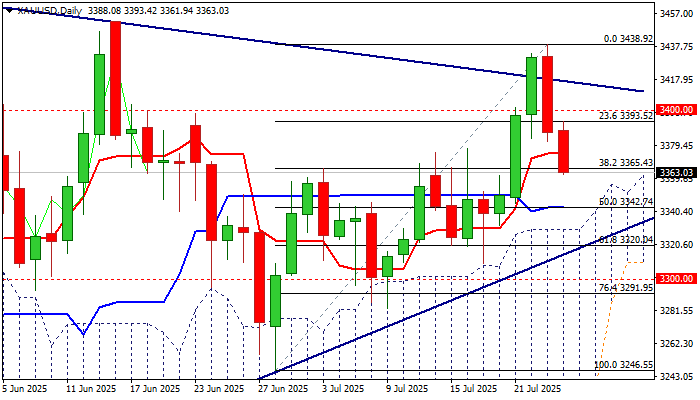

Fresh weakness emerged after bulls failed to register a clear break above trendline resistance (daily chart triangle’s upper boundary) with return below the trendline signaling a false break higher and generating bearish signal.

The yellow metal’s price lost around 2% since Wednesday’s opening and cracked pivotal support at $3365 (Fibo 38.2% of $3246/$3438, reinforced by 10DMA, with sustained break here to confirm reversal signal, following Wednesday’s completion of bearish engulfing and close below psychological $3400 support.

Technical picture on daily chart has weakened, although studies are still positive overall, suggesting that current weakness needs to find ground above the top of daily Ichimoku cloud ($3330) to keep larger picture bullishly aligned.

Otherwise, violation of cloud top and nearby lower triangle boundary ($3317) would generate stronger bearish signal and bring the downside at increased risk.

Res: 3393; 3400; 3419; 3438

Sup: 3342; 3330; 3317; 3309