Gold falls sharply on further cooling of Fed Dec rate cut expectations

Gold lost ground on Friday and fell over 3% following more hawkish tones from Fed policymakers that further dropped bets for December rate cut (below 50%, compared to 80% on Thursday and over 90% just a couple of days ago).

FOMC members argued their stance by increased concerns about inflation and relatively stable situation in the labor market, although still lacking the full information, as delayed economic reports are to be released.

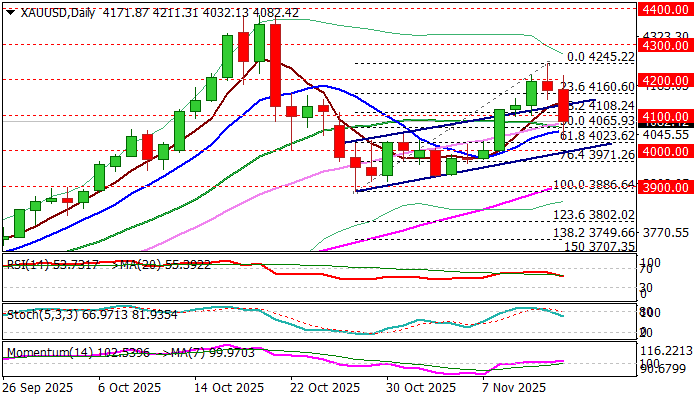

Quick drop below several key supports neutralized expectations for a healthy correction (dips to be contained by broken Fibo 50% / broken upper bull channel boundary at $4134) and soured the sentiment.

Near-term focus shifted lower after pullback from Thursday’s recovery peak ($4245) retraced nearly 61.8% of $3886/$4245 upleg, on dip to the session low at $4032 (that also exposed $4000 support (psychological / bull-channel lower boundary

However, hopes of fresh recovery are still alive due to quick bounce and supported by still bullishly aligned daily studies (positive momentum and MA’s in bullish configuration (converging 10/20DMA on track to form bull-cross).

Return and close above $4100 zone is minimum requirement to keep recovery hopes in play, with extension above bull-channel upper boundary ($4131) to validate fresh bullish signal.

Gold’s performance in the near future will depend on the incoming US economic data which will shape Fed’s stance on interest rates.

Res: 4100; 4108; 4131; 4160; 4200

Sup: 4065; 4032; 4038; 4023; 4000